Homeowners Insurance in and around Savage

Savage, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Home is where love resides laundry is continuous, and you enjoy coverage from State Farm. It just makes sense.

Savage, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

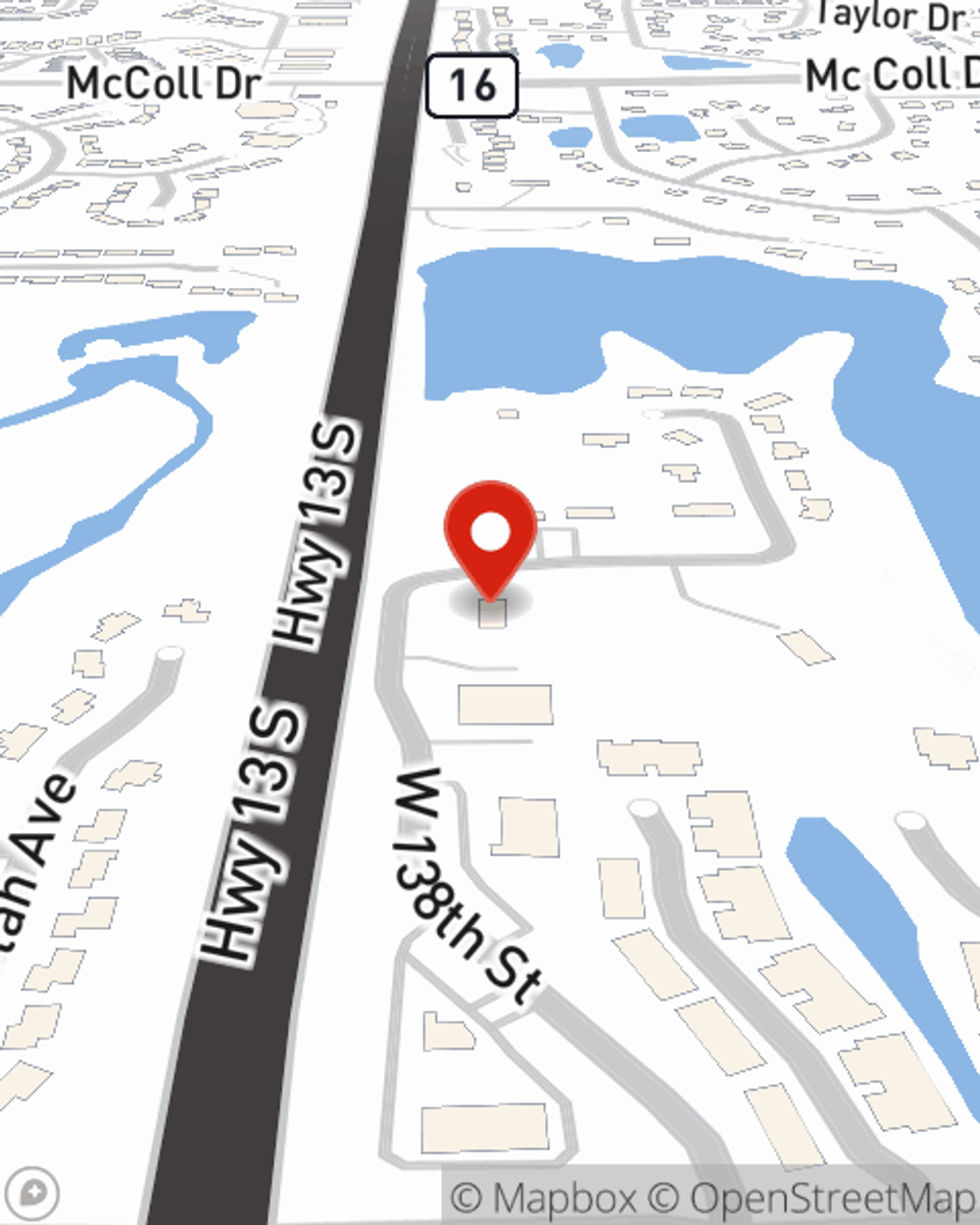

Agent Joe O'connor, At Your Service

State Farm's homeowners insurance protects your home and your possessions. Agent Joe O'Connor is here to help generate a plan with your specific needs in mind.

Outstanding homeowners insurance is not hard to come by at State Farm. Before the unanticipated takes place, reach out to agent Joe O'Connor's office to help you get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Joe at (952) 226-1500 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Joe O'Connor

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.